A Predetermined Overhead Rate In An Activity Based Costing System Is Called

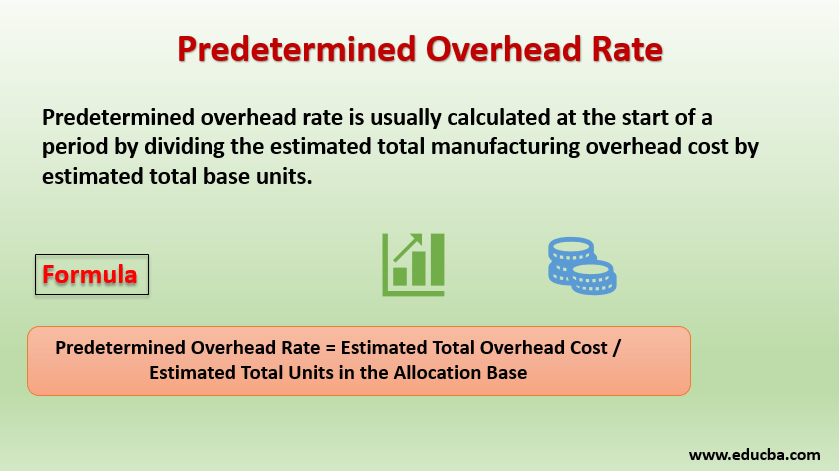

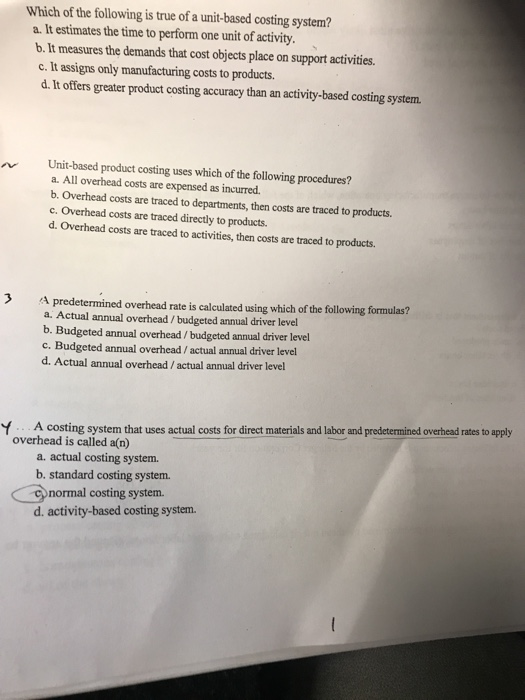

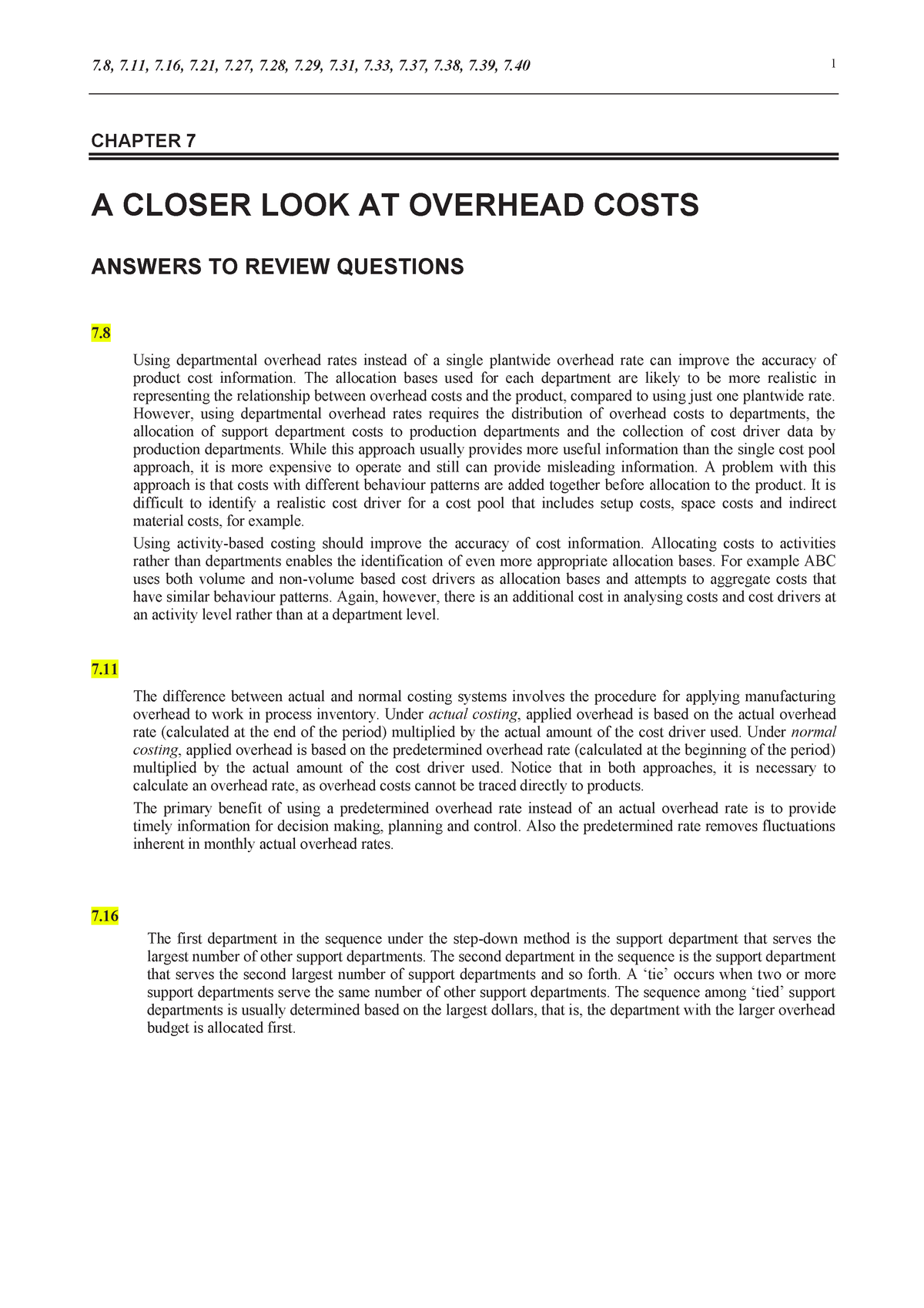

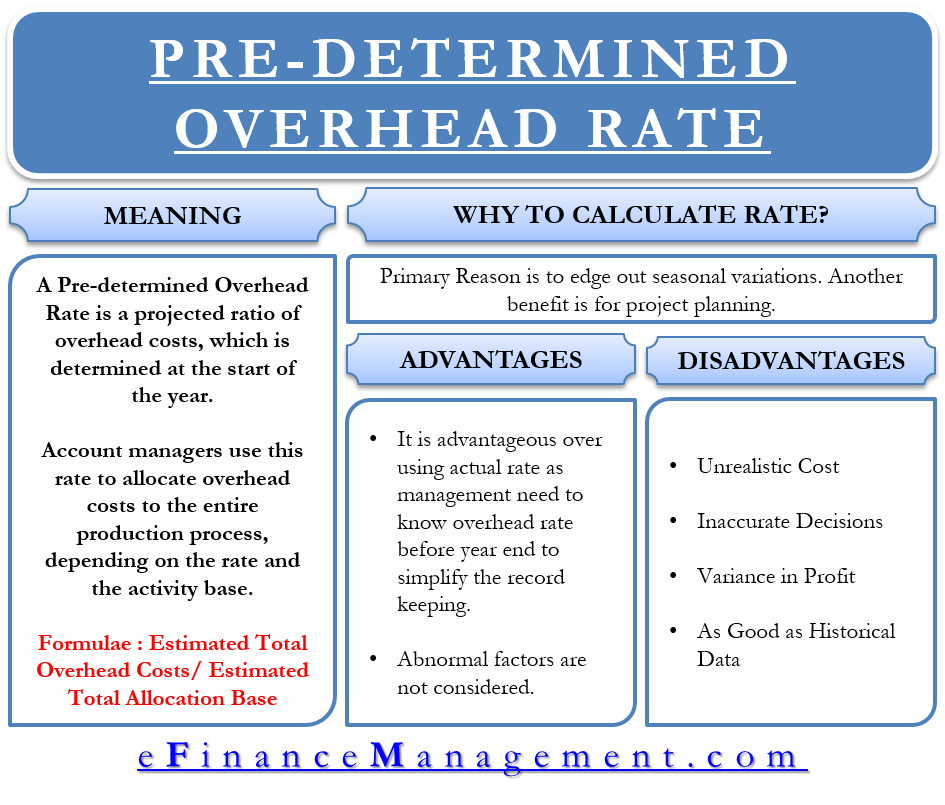

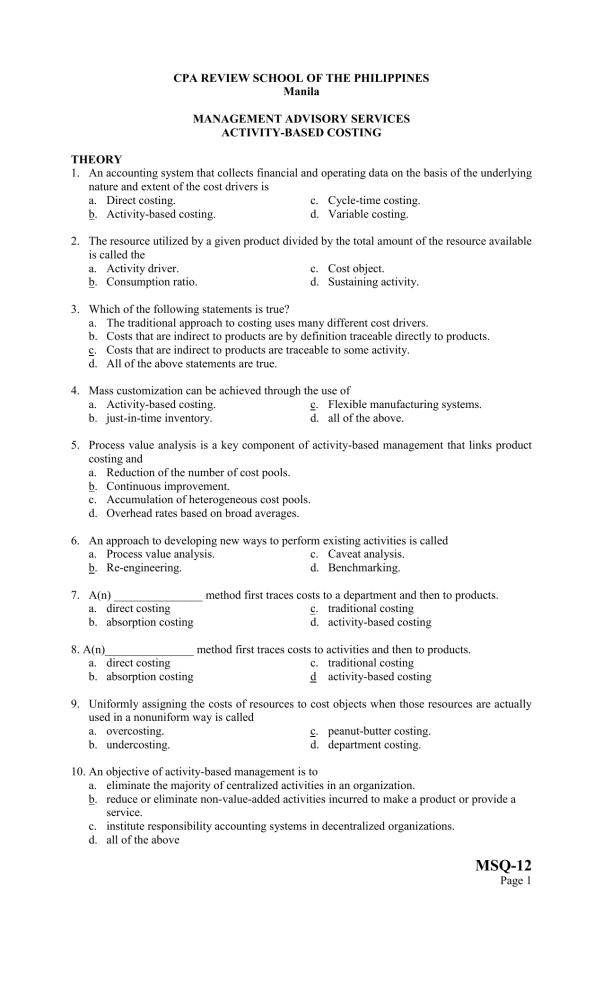

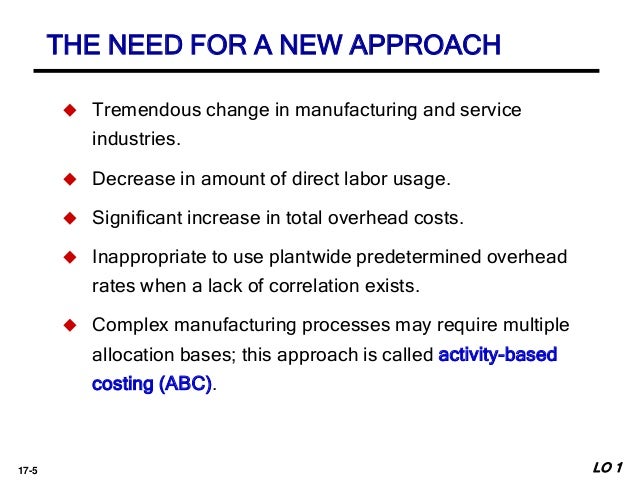

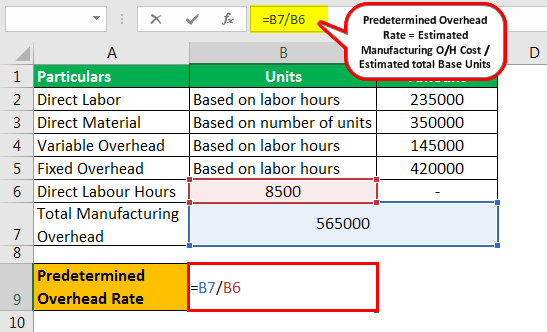

A predetermined overhead rate in an activity based costing system is called. In other words a predetermined rate is an estimated amount of overhead costs that managerial accountants calculate an activity base will use. Overhead rate budgeted annual driver levelbudgeted annual driver level. Predetermined overhead rates are calculated at the end of each year using the formula.

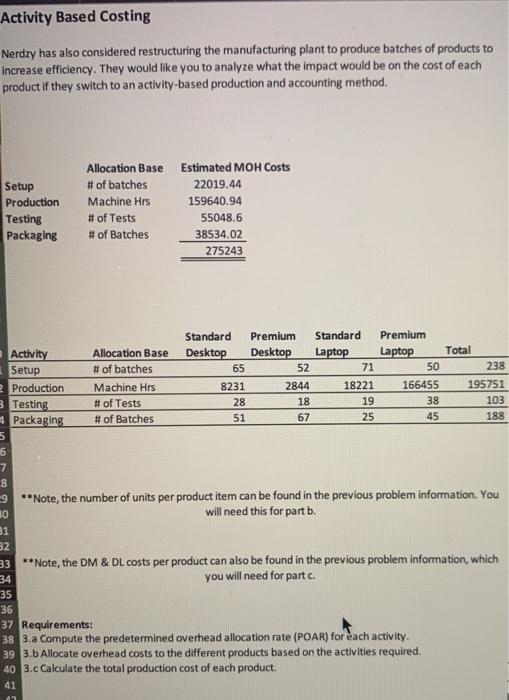

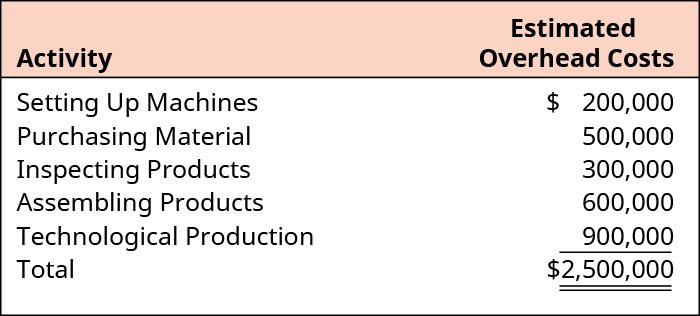

The company is looking at the possibility of changing to an activity-based costing system for its products. Overhead costs are allocated to activity cost pools. Compute the predetermined overhead allocation rate for each activity b.

Predetermined Overhead Rates Flexible Budgets and AbsorptionVariable Costing 1. September 16 2021 by Prasanna. Frequently increase the overhead allocation to at least one product while decreasing the overhead allocation to at least one other product.

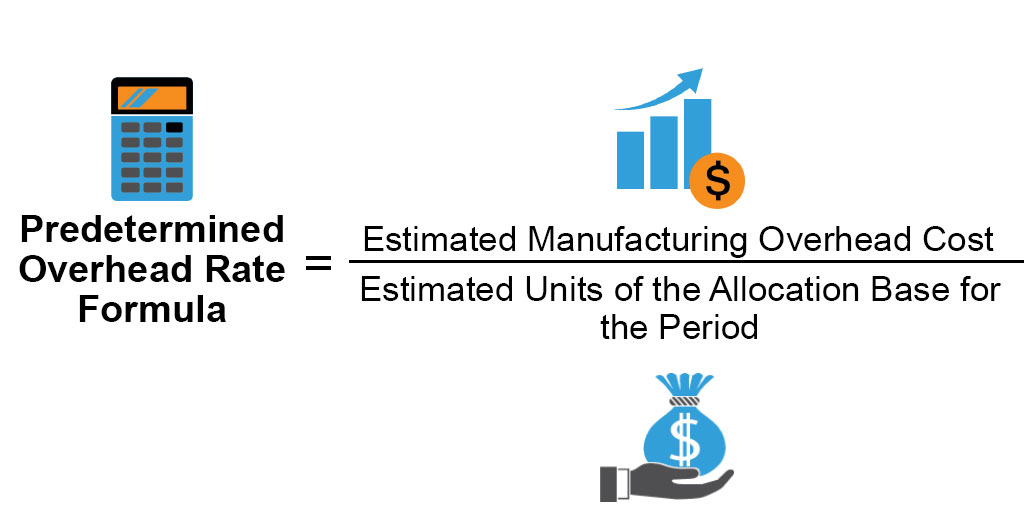

What is the predetermined overhead allocation rate using the traditional. The term predetermined overhead rate refers to the allocation rate that is assigned to products or job orders at the beginning of a project based on the estimated cost of manufacturing overhead for a specific period of reporting. Over the fiscal year the actual costs are recorded as debits into the account called manufacturing overhead.

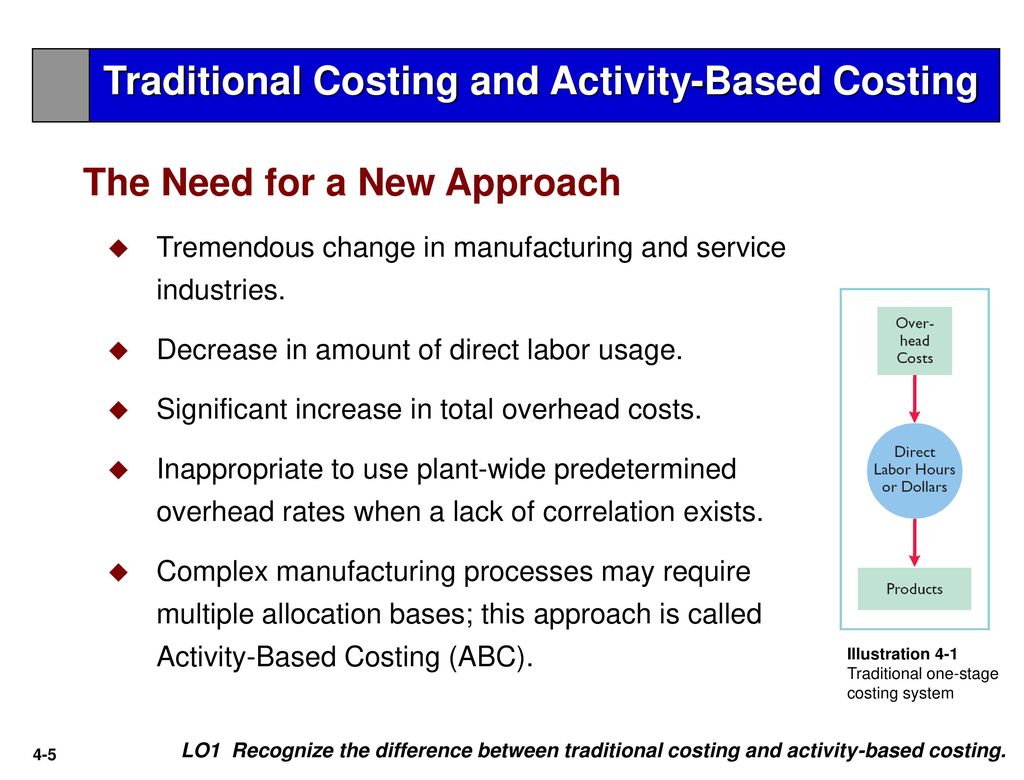

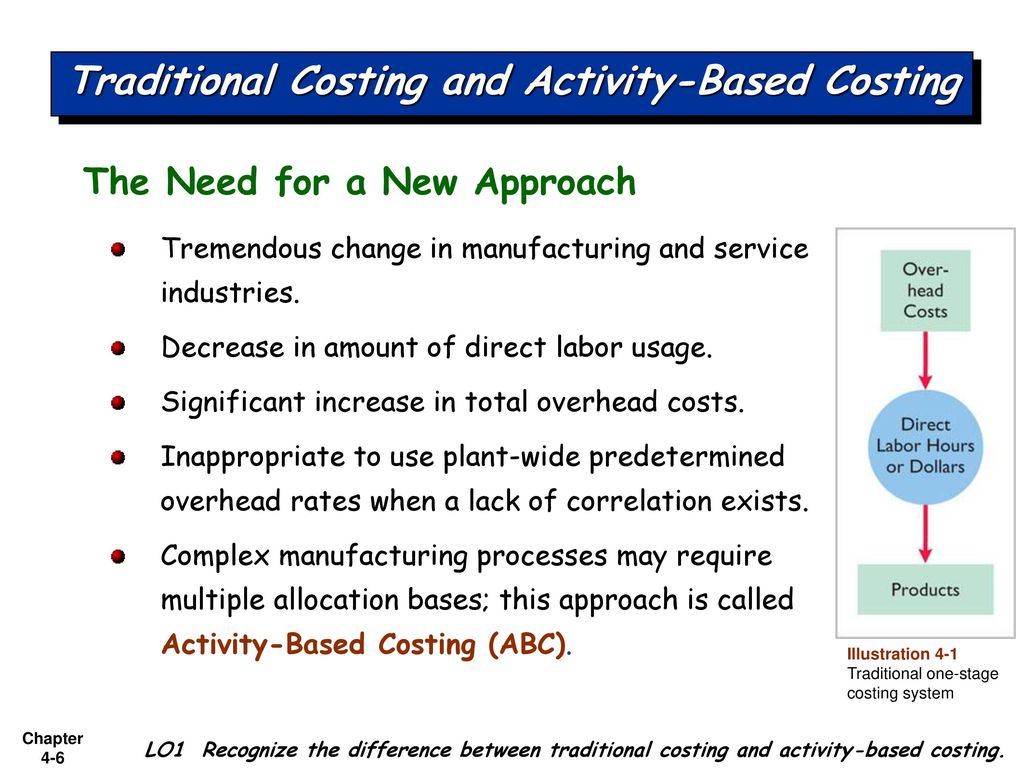

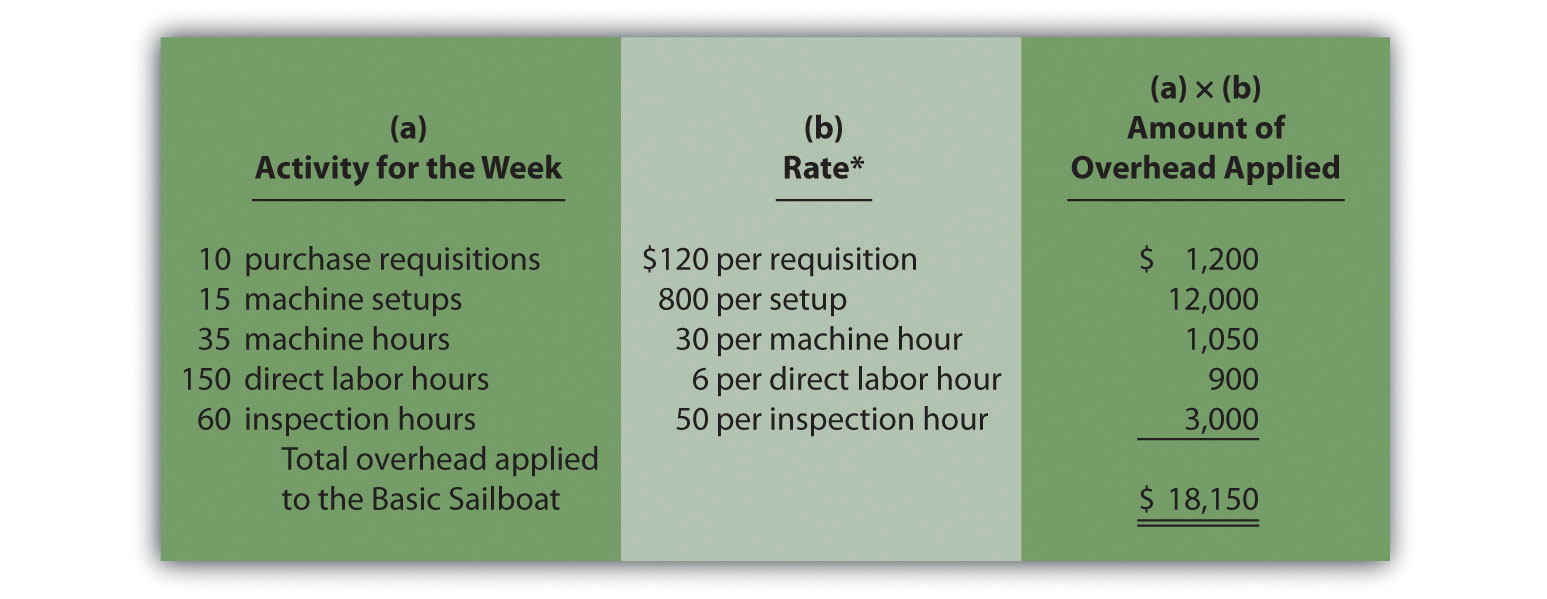

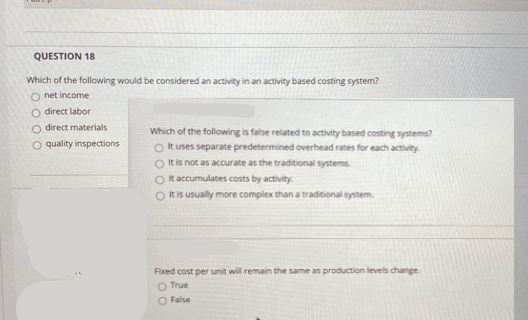

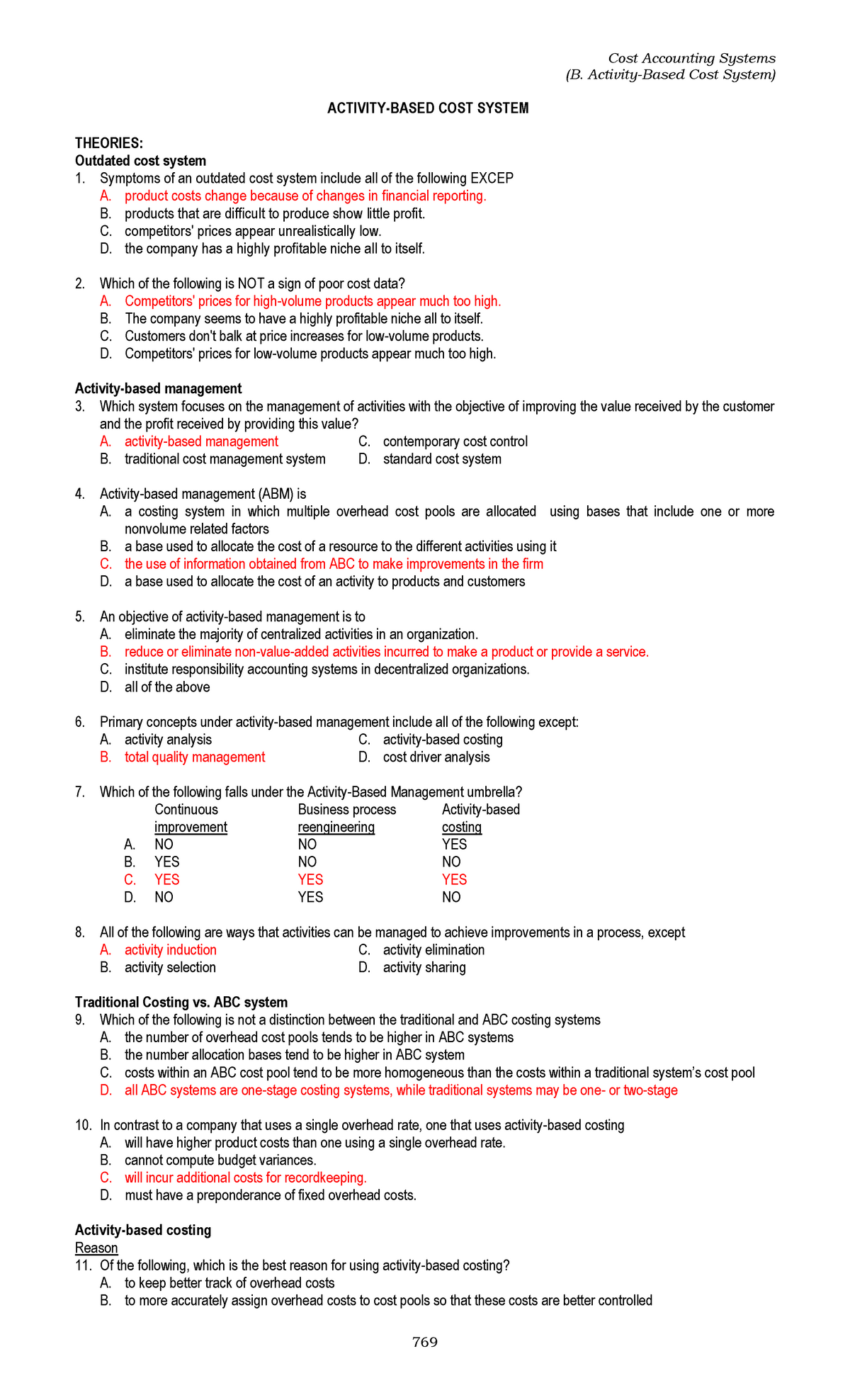

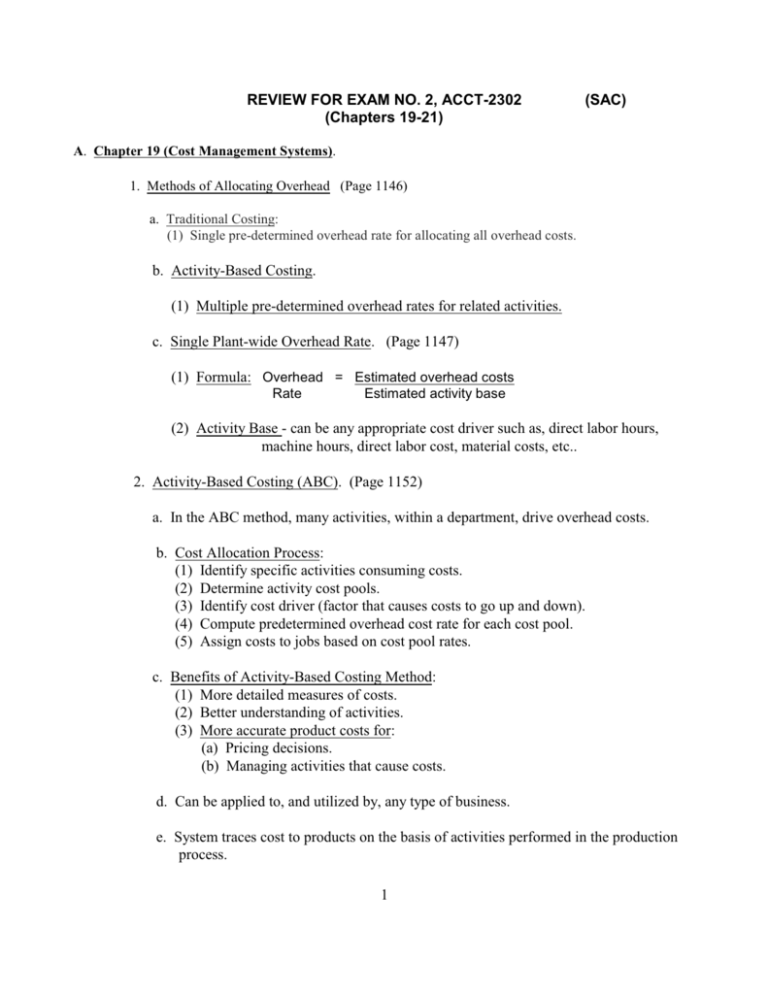

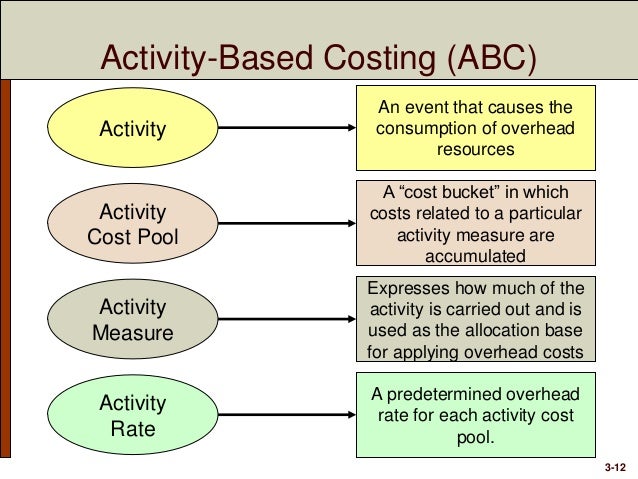

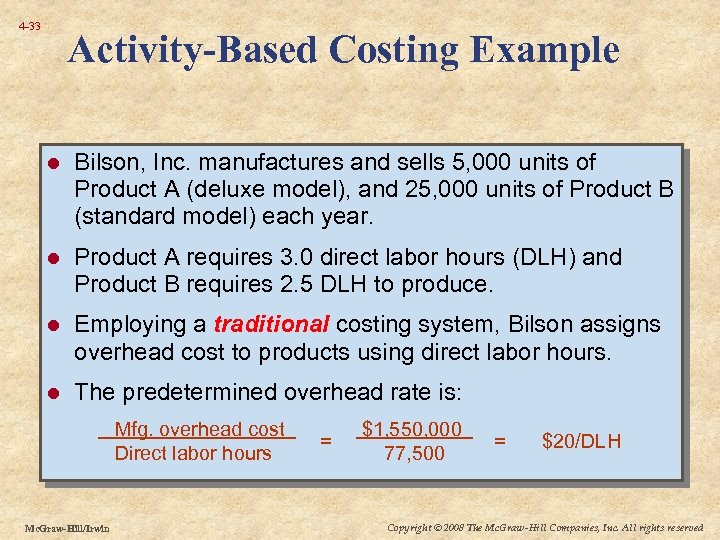

Variable costing is commonly used for internal reporting. Activity-based costing ABC A method of costing that uses several cost pools and therefore several predetermined overhead rates organized by activity to allocate overhead costs. A Predetermined overhead rate.

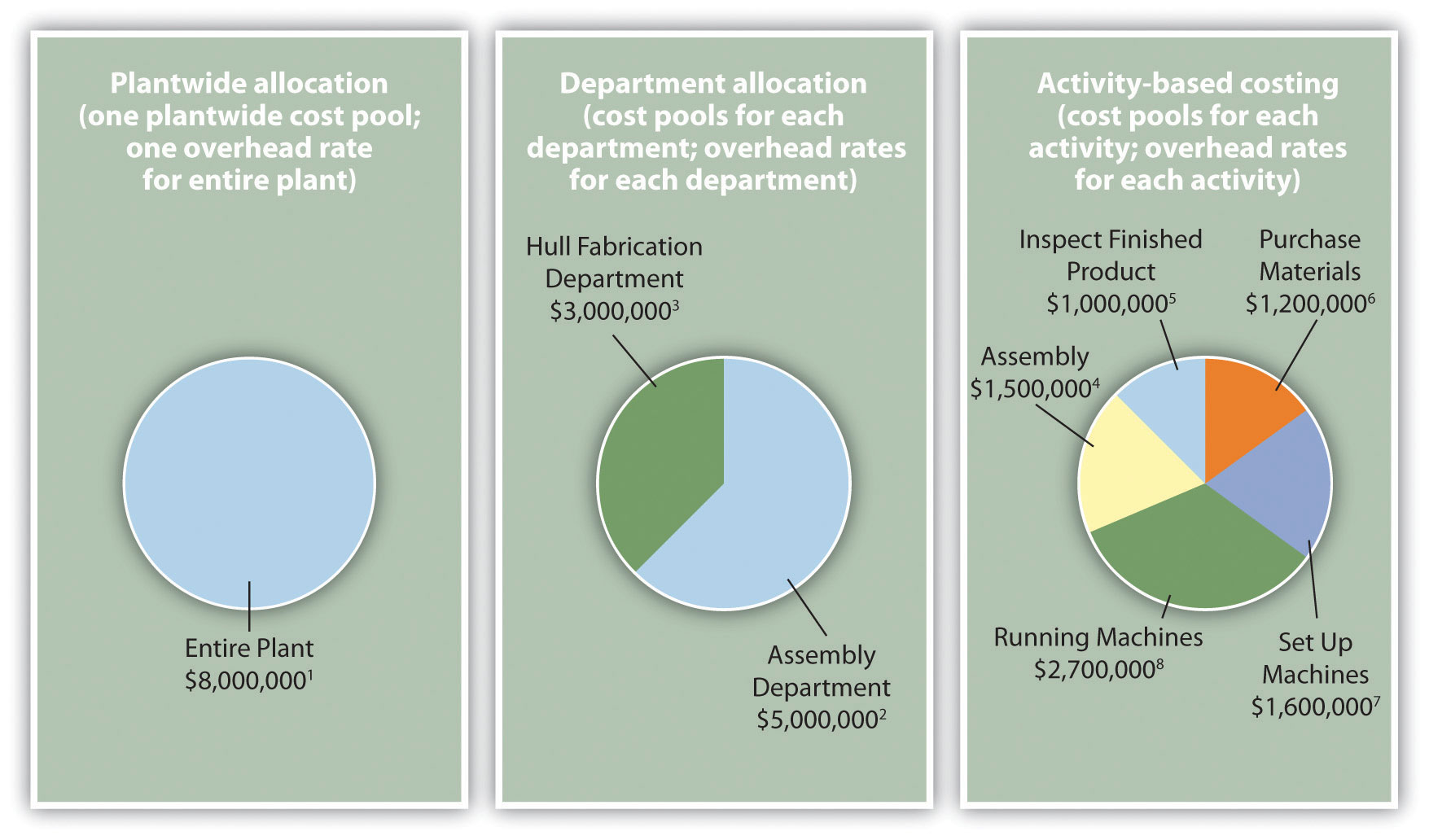

Predetermined overhead rate Total Overhead 100000 200000 200 per DLH Total DL Hour 50000100000 b Activities Overhead Cost Total Expected Activity Activity Rate Sewing machine hours 200000 1000 1000 SMH 10000 per MH Machine setups 100000 400 100 setups 20000 per setup Activity Nylon Leather Rate Activity Amount Activity. One cost pool accounts for all overhead costs and therefore one predetermined overhead rate is used to apply overhead costs to products. This activity base is often direct labor hours direct labor costs or machine hours.

Absorption costing is commonly used for external reporting. Identify the cost driver for each activity and then estimate the quantity of each drivers d.

Frequently increase the overhead allocation to at least one product while decreasing the overhead allocation to at least one other product.

Predetermined overhead rate Total Overhead 100000 200000 200 per DLH Total DL Hour 50000100000 b Activities Overhead Cost Total Expected Activity Activity Rate Sewing machine hours 200000 1000 1000 SMH 10000 per MH Machine setups 100000 400 100 setups 20000 per setup Activity Nylon Leather Rate Activity Amount Activity. The predetermined overhead rate is set at the beginning of the year and is calculated as the estimated budgeted overhead costs for the year divided by the estimated budgeted level of activity for the year. Uses several cost pools organized by activity to allocate overhead costs. Predetermined overhead rate is used to apply manufacturing overhead to products or job orders and is usually computed at the beginning of each period by dividing the estimated manufacturing overhead cost by an allocation base also known as activity base or activity driver. Predetermined overhead rate Estimated overhead costs Estimated activity in allocation base When activity-based costing is used the denominator can also be called estimated cost driver activity. Plantwide rates are the easiest to apply but can cause cost distortion because all overhead resources are treated as though they are equally consumed by all cost objects. Identify the cost driver for each activity and then estimate the quantity of each drivers d. September 16 2021 by Prasanna. Limit the number of cost pools.

One cost pool accounts for all overhead costs and therefore one predetermined overhead rate is used to apply overhead costs to products. A Predetermined overhead rate. Predetermined Overhead Rates Flexible Budgets and AbsorptionVariable Costing 1. The predetermined overhead rate is set at the beginning of the year and is calculated as the estimated budgeted overhead costs for the year divided by the estimated budgeted level of activity for the year. Predetermined overhead rate Estimated overhead costs Estimated activity in allocation base When activity-based costing is used the denominator can also be called estimated cost driver activity. In other words a predetermined rate is an estimated amount of overhead costs that managerial accountants calculate an activity base will use. Use a single predetermined overhead rate based on machine hours instead of on direct labor.

Post a Comment for "A Predetermined Overhead Rate In An Activity Based Costing System Is Called"